I recently bought Dave Ramsey’s Financial Peace Jr. for teaching kids how to win with money. Here is my review of Financial Peace Junior, why I bought it, and what I think of the product. Financial Peace Junior is a hands-on, engaging program designed to teach kids the value of money, hard work, and smart financial habits. Based on Dave Ramsey’s principles, it helps children learn the basics of earning, saving, giving, and spending in a fun and practical way. With interactive activities and real-life applications, Financial Peace Junior empowers kids to develop lifelong money skills while building responsibility and confidence.

Why I bought Financial Peace Jr. For My Child

The hallowed toy isle. Whatever store I was in, if it had one, I would find it. And once my father would eventually catch up to me, I would grab his hand with my tiny fingers and drag him down the lane to show him all my prized selections. Either I was trying to break him down with my cuteness, or the Lord blessed me early with frugality because as I stopped at each toy, I asked the same two questions. “How much is this daddy?” and regardless of what came out of his mouth I followed with, “is that a lot?”

Children are not oblivious to the concept of money. Much like everything else, they are absorbing how you handle your finances. They are watching you, closer than the IRS, because they quickly learn that it takes a magical piece of paper (or plastic) to acquire things like toys and snacks and fun. That’s why teaching children the value of money from a young age is a great step to setting them up for future success. Trust me, you don’t want them just starting to figure out this money thing in college, or you’ll have them calling you up to by them a pizza at 1:00 am because they are starving (college students are great guilt trippers). Money guru Dave Ramsey has a variety of wonderful products to help get your family on the financial right track.

Financial Peace Jr. Review

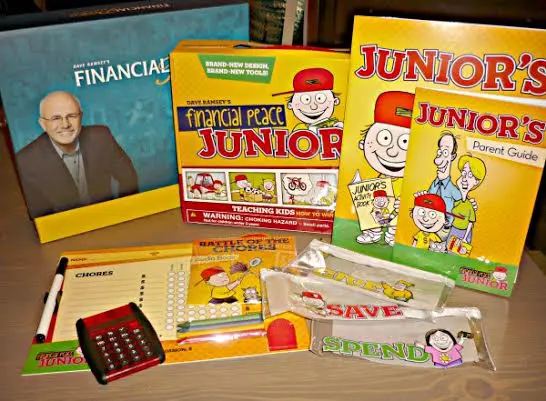

Dave Ramsey’s Financial Peace University, Junior Edition is a great program with all kinds of fun tools for children ranging from ages 3 to 12. This is not a sponsored review. Here is an affiliate amazon link for your convenience.

Financial Peace Jr. toolkit includes:

- Junior’s Parent Guide gives step-by-step instructions on how to use the kit and provides insight into what money concepts kids are capable of understanding in different “ages & stages.”

- Junior’s Activity Book– filled with fun illustrations, coloring pages and activities to engage kids of all ages in the chapter lessons.

- Smart Kids Launch Pad chart with reward stickers to celebrate the completion of each activity.

- Chore Chart with magnetic chore labels and one dry-erase pen so kids can mark their progress on age-appropriate chores.

- Give, Save & Spend envelopes

- Smart Money, Smart Kids ebook to take your kids to the next level.

Financial Peace Junior Kit is filled with resources for both children and parents to make it a family learning experience. Parents can refer to the parents guide while kids can enjoy the activities and exciting games for Junior. It is a great way to make the power of financial peace part of your daily life.

There are a bunch of awesome chore ideas that can be easily tailored to your child’s age level. The program also ingeniously helps motivate children who are not too excited about helping out around the house by making chores more “commissioned” based and not under a blanket allowance. Why not help your family work together and eliminate undue stress?

The activities are designed to foster a healthy work ethic. However, they still let children enjoy it through the fun stories, toys, and games provided in junior’s activity book. It helps to know how and when to introduce kids to basic concepts so they can become money-smart kids.

Tackling the important issue of money doesn’t have to be as intimidating as it may seem. It’s a lot easier to digest when it’s broken down in easy to follow steps.

I came across Ramsey’s junior products while using the adult Financial Peace University. I find that version helpful for families, and adults who still play make believe with their money, like I do! Lots of laughs. As I’m just starting out my family with a baby boy, I again find myself ending up in every toy aisle. I can’t help but want to buy him everything. And again, I’m constantly asking when considering a purchase, “how much is this…is that a lot?” Because I’m focused on investing in my son’s future, I’m trying to make the right financial decisions now. And I can’t wait for the things I get to teach him as he grows!

Just remember, whatever your financial situation is, it’s never too late to start making smarter decisions. Go ahead and give your bank account some peace!

Related Posts:

corinne @ one income life says

Hi Lindsey. I love Dave Ramsey! We didn’t buy Financial Peace University, but my husband and I did follow his baby steps to get our of debt shortly before our 2nd child was born. We’ve remained debt free for the last 3 years and it’s wonderful.

Thanks for sharing this!

Tanya Schaaf says

Love this! Wish I had this years ago. Our children and grandchildren so need to learn these concepts as we will be in unchartered waters of debt that our government can’t seem to get under control! New parents could really benefit. Thank you! 🙂

Talking to Children About Money says

I think that it is very important to teach your children about money at a young age. It will teach them that things cost money and realize that it might take some time to save up for something that they really want. I also think it is a good idea to let the kids know about the family’s finances, after all, there are times in our lives when money is super tight and I think the kids can help come up with ideas how to save money. I know that my parents did a great job at teaching me about money, I bought my own car and paid the gas/insurance/maintenance. At that time, my parents didn’t really have the money to pay for these things and I am glad that they didn’t help me. I worked part time to pay for my stuff and it taught me how to appreciate the things I have. I didn’t make a ton of money in high school but it covered my expenses and some fun money.