Let’s face it. Teaching teens money management isn’t easy but it is essential. Just like everything else, it takes a little practice. I don’t want my kids having to practice balancing their bank account and using credit cards for the first time when they are away at college. I want to let them get practice while they are still at home. In fact, we have been taking baby steps in that direction since they were old enough to do chores and earn some money. Learning to use a debit card is an important part of money management teens need to learn. Now Greenlight Card for teens and kids makes that possible. This post is sponsored by Greenlight. All opinions expressed are my own.

Teaching teens money management starts with talking to kids about money and helping them open a savings account. Once kids are 13 and up they can even open a checking or savings account. This is allowed as long as a parent co-signs the account. Having them know how much money they have, when they have a chance to earn more money, how they are spending their money, and how much money they are saving is crucial. This is the basis of allowing them to feel comfortable with money. Debit cards for kids is just one way that teenagers can learn to track how much money they have to spend, and what they are spending it on.

The Greenlight Card For Kids And Teens Builds Money Management Skills

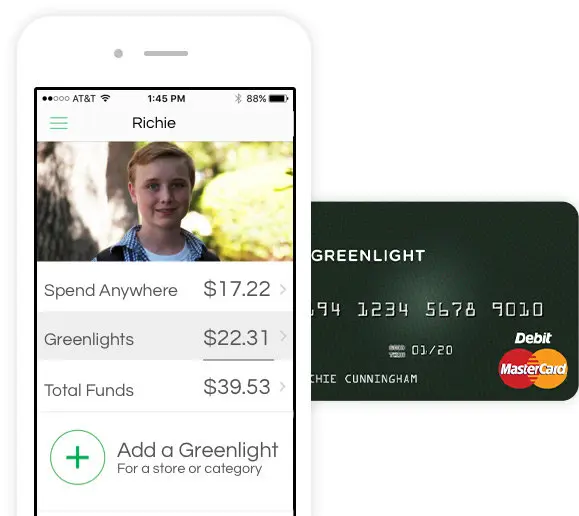

Looking for a teen debit card? Look no further. A Greenlight debit card for teens is the perfect way for teenagers to be able to learn to use a debit card with their parents’ guidance. (It is not a credit card.) Parents can manage the child’s debit card from their phones using parental controls.

The Greenlight debit card is actually designed for kids ages 8 to 18. It can easily be managed by parents from the Greenlight App. The parent account makes Greenlight ideal for savvy parents of teens who want to empower them to make smart decisions with money. At the same time, it helps guide them and keep them out of trouble. The Greenlight Card is actually the only debit card that lets you choose the exact stores where kids can spend. Pretty cool! This smart debit card can let your kids spend anywhere or only at select locations you select.

Teens with jobs can set up Direct Deposit and have their paychecks sent straight to their Greenlight account. This is a great way to allow them to have different experiences with money. It increases financial literacy at the same time.

Features Of The Greenlight Debit Card That Make It A Great Tool For Teaching Money Management:

- Through the Greenlight mobile app, parents can choose the specific stores or categories where their kids can spend money; they call those greenlights. The Greenlight card is the ONLY debit card in the world that offers this unique capability.

- Greenlight debit cards for kids come with your child’s name (and PIN) built in. Only he or she can use it.

- Additional layers of protection in the form of face or fingerprint recognition.

- Greenlight debit cards are FDIC-insured up to $250,000, and come with Mastercard’s Zero Liability Protection.

- A Greenlight debit card for teens can be instantly shut off. This is a nice feature if they misplace the card or they get grounded. This can be done from either your phone or your child’s phone.

- Money can be instantly transferred from the parent’s bank account onto their kids’ Greenlight Cards through the mobile app. This makes it easy for parents to pay allowance and for kids to manage their allowance money. You can even set Greenlight to pay allowances automatically.

- Greenlight reporting lets the parent and child review spending choices together.

- Greenlight debit cards for kids can be used internationally if your child is traveling or studying abroad.

- The Greenlight debit card for teens can be used with Apple Pay.

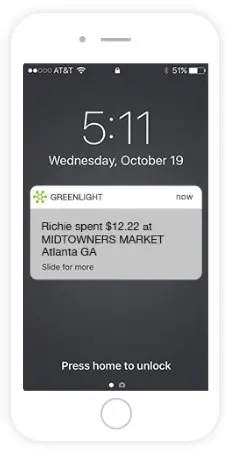

- Greenlight sends parents a real-time notification every time their child uses the debit card. You know where they are shopping and how much they spent. You get store-level controls.

- If your children’s debit cards run out of sufficient funds, you can send money to your kids anytime, anywhere. This makes the Green Light Card a good option to save the day when they are in a pinch.

- Support Team is available 24/7.

Greenlightcard Q& A

How do Greenlight Cards work?

A Greenlight account provides debit cards for up to 5 kids, and educational app plus other financial tools and benefits. Greenlight plans start at a low monthly fee of $4.99 per month. Kid are even encouraged to learn about savings goals with Greenlight Savings Reward where they can earn up to 2% interest rates. One month trial available. To prevent overspending, Greenlight typically does not allow overdrafts. This helps teens learn responsible money management.

There is also a Greenlight Max plan that includes an investing platform. It teaches about the fundamentals of investing and allows kids to invest in their favorite stocks and ETFs- with parent approval required, of course.

Can the Greenlight Card be used at an ATM?

You get to choose exactly where your kids can spend. Set ATM cash withdrawal limits, too. Greenlight sends real-time transaction notifications and gives parents flexible ATM and other spending controls.

How to cancel Greenlight Card?

You have the ability to turn the card on or off, directly in the app. So you can cancel it short term if you child is not behaving responsibly.

Do you think the Greenlight debit card would be a money management tool your teen would like to try? Try it for free. You can learn more and get the app at greenlightcard.com.

Amazon + Greenlight: Helping Teens Effectively Manage Money

Amazon just announced that parents can add teens to their Amazon household account for free. You also get the flexibility to either approve every order or set pre-approved spending limits. Teens can now explore Amazon with the independence of their own login while still giving parents final control.

As Greenlight CEO Tim Sheehan said, “Teens want independence, parents want convenience. Amazon’s new offering is a natural fit blending the two. That said, we believe a much larger opportunity exists to help parents teach their kids about how to be smart with money — learning to spend wisely, the importance of saving, giving back when you’re able to, and investing to build wealth for the long-term.”

Conclusion

The Greenlight card is a popular financial tool designed for families to teach kids and teens about money management. Greenlight provides parents with the ability to set spending limits, control where the card can be used, and receive real-time alerts for transactions. The platform also allows parents and teens to set savings goals, encouraging responsible financial habits. Furthermore, Greenlight includes features to educate teens about personal finance, including lessons on budgeting and saving.

I think Greenlight’s debit card is changing the way we can teach our kids and teens about money and let them practice managing it responsibly. Young people can use real money, with parent approval, to complete a variety of transactions. This ranges from shopping at grocery stores to making charitable donations with their own money. It is an easy way to teach kids about money from a young age and add more freedoms for older kids.

The Greenlight card is the perfect teenage debit card to give them freedom with parental checks. It is even great for using in conjunction with rewarding kids for chore lists. Amazon and Greenlight are both making it easier to talk to our kids about how we handle money and what we spend. Do you talk to your kids about how they manage their money?

Related Posts: