We all want what is best for our children and we put a lot of effort into raising our children to that goal. We want them to be happy, succeed at their pursuits, and not to have to struggle financially. Most parents want their kids to go to college. Not only is it a fun and formative time for your child both socially and academically, according to Education Corner, “studies show that college graduates earn significantly more money throughout their lifetime than those with only high school education”. If you want to start saving for your child to go to college, one of the best things you can do is open a 529 account. I have partnered with Raise Financial to show you how to open a 529 college savings plan quickly and easily. It only took me a few minutes and it was free!

Scholar Raise is a platform that aims to minimize student debt by empowering people to save for college the best possible way and that is a beautiful thing.

Why A 529 College Savings Plan Beats A Savings Account

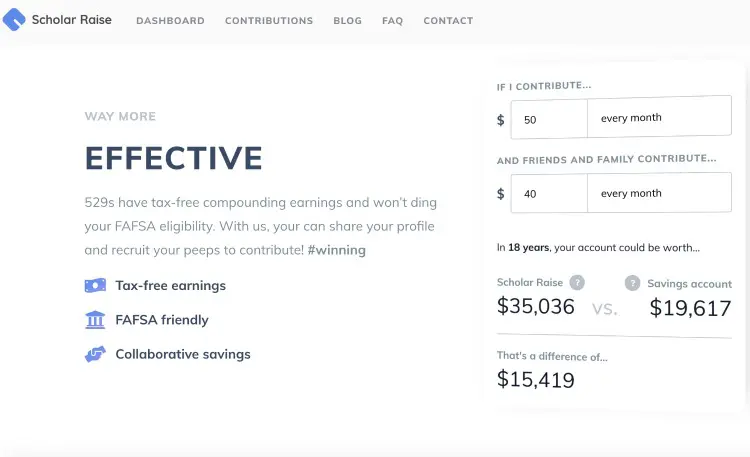

As a parent who has always known that I want my kids to go to college, I wanted to start saving for college early. I struggled with just how to do that. First, I thought of a savings account for them. Then I found out that a 529 College Savings Plan beats a savings account hands down. A savings account can effect FAFSA eligibility and you don’t want to hurt their ability to qualify for Federal student aid. The 529 College Savings Plan is also superior because it offers tax-free earnings.

My problem then became how to open a 529 College Savings Plan. I had so many questions. Did I need a financial planner? Did I have to be rich to start to make starting a 529 worth it? Furthermore, did I need to commit to a monthly amount? Did I have to be able to come up with a minimum amount to open the account? I found the whole thing a bit overwhelming. Finally, I met with a financial advisor who let me know that he would be happy to open a 529 College Savings Plan for me if I had a certain minimum amount to invest. Since I did not have the minimum he asked for, he suggested that I go online and check out my state’s 529 options.

I then did some research trying to find out my options and what was the best 529 College Savings Plan and what rules might apply to the different options. Long story short, it was quite a confusing process. But here is the really good news, Scholar Raise makes it so easy to open a 529 College Savings Plan!

Another thing I learned through Scholar Raise, is that “With an average 6% annual return, a 529 plan has much better performance than savings accounts which often earn less than 0.08% per year.” They even have an amazing calculator that shows you just what a difference a 529 can make compared to a savings account. I wish I had known sooner!

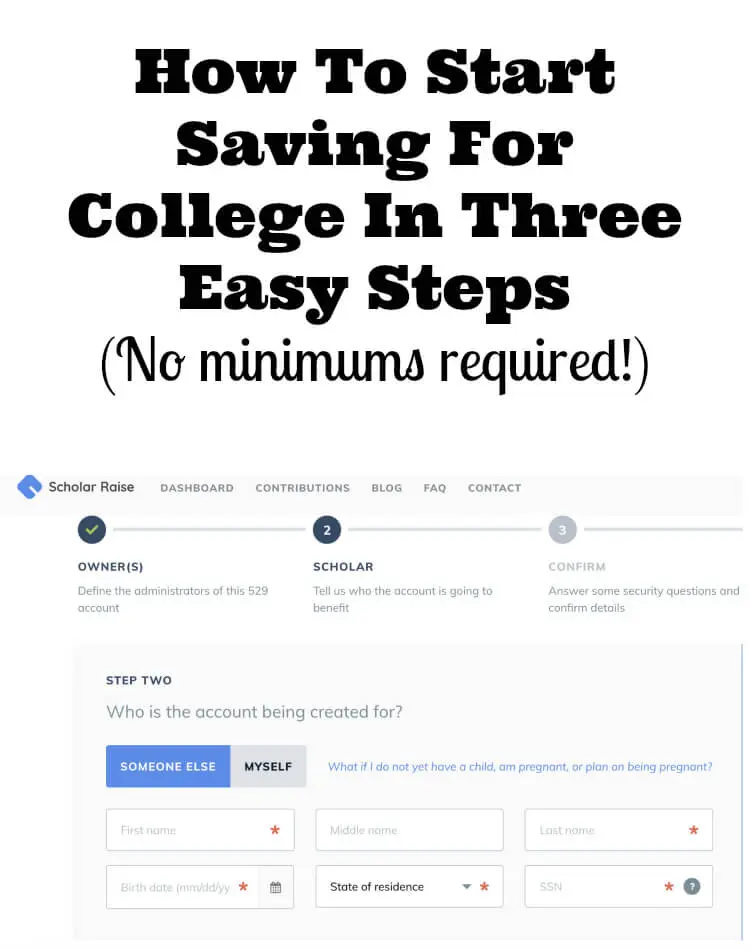

How To Open A 529 Account In 3 Simple Steps

- Go to scholarraise.com and click on “Start Saving”

- Provide your basic info

- Create a plan by providing your child’s basic info

That is it. Free and easy. Literally in under 5 minutes, you can set up a 529 for your child. What a weight off your mind that will be! No degree in finances needed to figure it out how to open a 529 college savings! No minimums! So empowering!

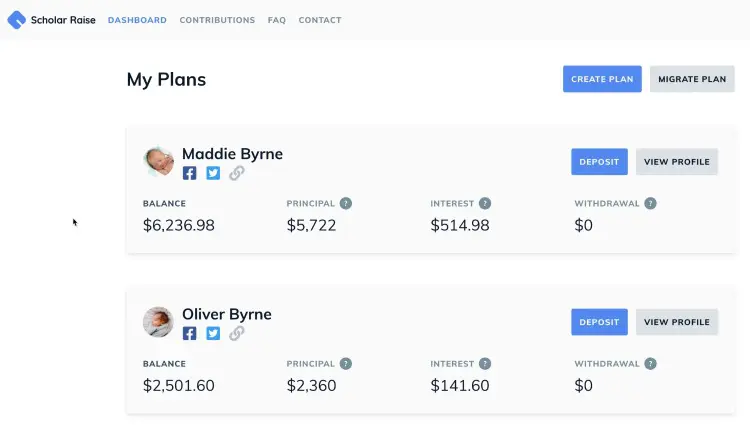

Scholar Raise does all the heavy lifting and sets up everything for you. They have scoured the country for the best 529 plan based on a variety of factors (such as a low management fee, great returns, and tax advantages). They provide you access to a great, easy to use dashboard where you can see your savings and earnings and share that information with your children as well to get them excited to save and earn!

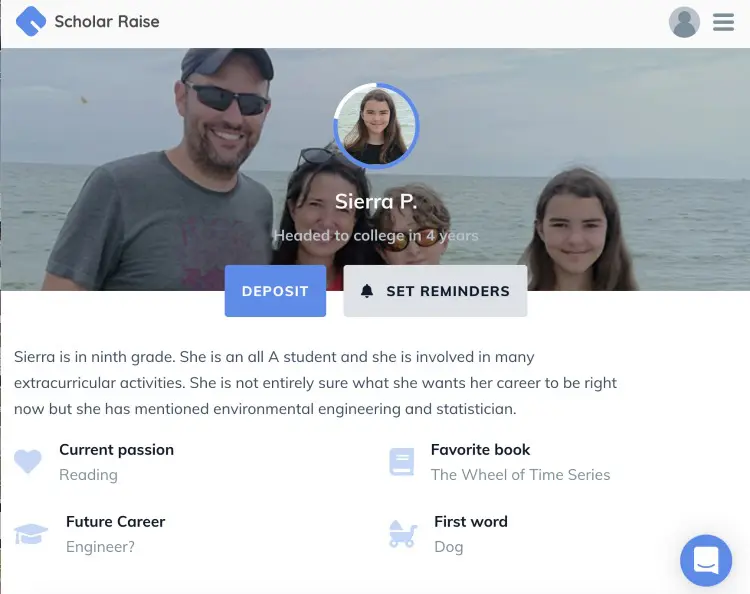

Scholar Raise Makes College Savings Contributions Easy For You, Family, And Friends

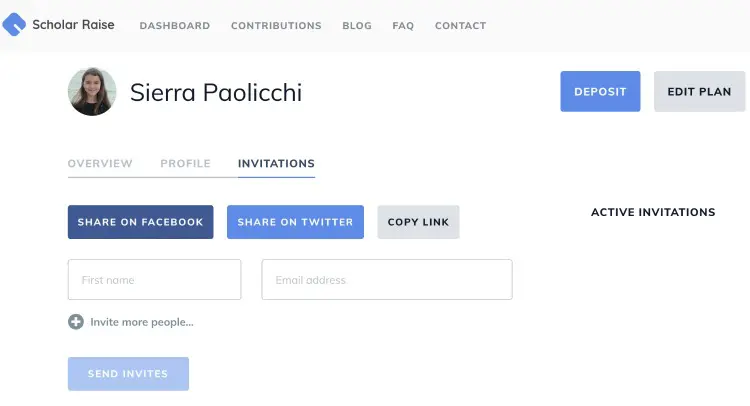

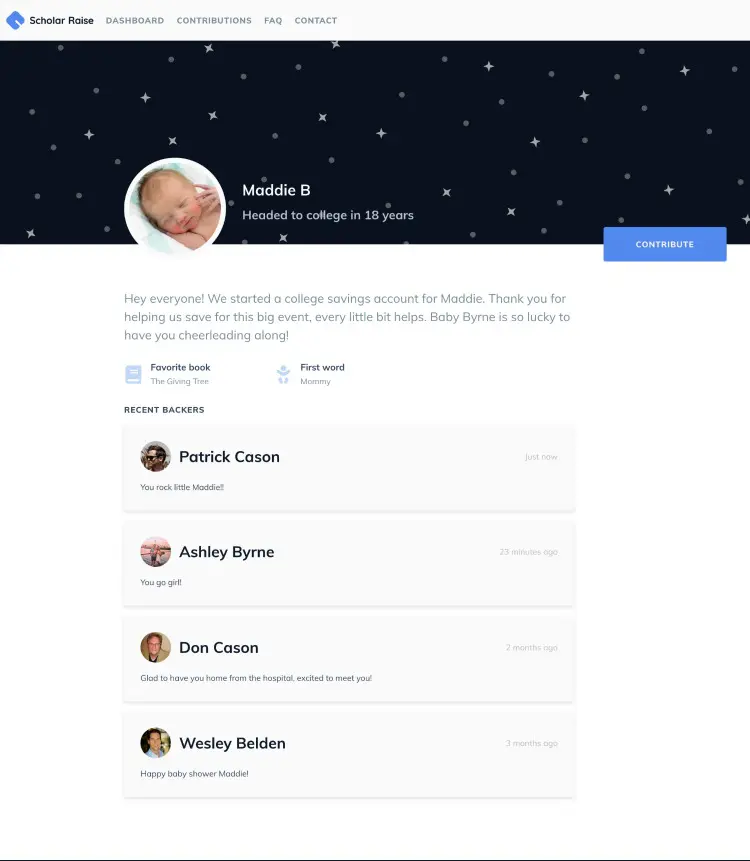

The Scholar Raise dashboard makes it easy to contribute. You can set up recurring contributions. You can pause them if you need to, or deposit extra when you have it. It also makes it easy for friends and family to help save for college! You can send an invitation to your child’s profile and their private info is kept private but it allows for direct contributions. This is perfect for when you set up the account and you are excited to share the achievement. It is perfect for birthdays and holidays too! They make it easy to send invites via Facebook, Twitter, or email. <- Click that link to see how they look!

It is really great how Scholar Raise makes savings collaborative by providing you with a scholar profile and unique URL to share with friends and family. Friends and family can stop struggling with what your child will enjoy. They can use Venmo card, PayPal card, credit card, or bank account and their gift goes directly and immediately into your child’s 529 plan. Then you get a notice of the deposit. And you can check your dashboard to see all contributions listed in one place which makes it easy to stay organized and see what is happening.

When should you open a 529 Plan?

Once the child is born, the sooner the better! You can start a 529 plan for your child or grandchild as soon as you as you receive the Social Security number.

Save early & often – even with only $25 per month. Second, stick with it. Over time, even $25 per month will add up – and add up faster by compounding in your 529 account.

Conclusion

Opening a 529 plan offers several benefits for saving for future educational expenses. Here are some key reasons to consider:

- Tax Advantages:

- Tax-Free Growth: Earnings in a 529 plan account grow federal tax-free and generally aren’t taxed by states when used for qualified education expenses.

- Tax Deductions: Some states offer tax deductions or credits for contributions to a 529 plan. Consult your tax advisor.

- Flexibility:

- Wide Range of Qualified Expenses: Funds can be used for tuition, fees, books, supplies, equipment, and sometimes room and board for college, K-12 tuition (up to $10,000 per year), and even certain apprenticeship programs.

- Control: The account owner maintains control over the funds, including choosing the beneficiary and the timing and amount of withdrawals.

- High Contribution Limits: 529 plans generally have high lifetime contribution limits, often exceeding $300,000, allowing for significant savings over time.

- Estate Planning Benefits: Contributions to a 529 plan are considered completed gifts for tax purposes, so they can reduce the taxable value of your estate while retaining control over the assets.

- No Income Restrictions: Unlike some other tax-advantaged accounts, there are no income limits for contributing to a 529 plan, making it accessible to families of all income levels.

These benefits make 529 plans a popular choice for families looking to save for education while taking advantage of tax benefits and flexibility. In addition, if the original beneficiary does not use the funds, you can change the beneficiary to another qualifying family member without penalty. Saving a dedicated account for education can help you stay focused on saving for future educational expenses.

I hope you found it useful to learn just how easy it is to open a 529 college savings plan. What I love most about Scholar Raise is that it makes college savings attainable for anyone and everyone! It is free and it just takes minutes. It couldn’t get any better and there is no pressure and no minimums required. Visit raisefinancial.com and open a 529 account today. You will be so glad you did!

Related Posts:

Tips For Navigating The College Process