As parents, it is our responsibility to teach our children financial awareness. This includes showing younger kids how to budget their money from an early age. Including them as a part of the family budgeting plans is a great thing, but it does not relate directly to them on their level. Therefore, helping your kids set up a budget of their own will teach them on a smaller scale what it is that you do every month with your finances. If you child is old enough to have an allowance, they are old enough to learn budgeting for kids. I have included a free budget worksheet for kids to help them get started. It is a great hands on way for them to answer what is a budget for kids.

Teaching Kids About Budgeting Provides A Firm Foundation

“Choose my instruction rather than silver, and knowledge rather than choice gold; for wisdom is better than jewels, and all that you may desire cannot compare with it. I have good advice and sound wisdom; I have insight, I have strength.” ~ Proverbs 8:10, 11, 14

There is a lot to learn about money. Children of a young age can begin with a piggy bank. Next, younger children can get a savings account. Then as they gain control of their money, they can get a checking account, and a debit card for teens. This will help provide young people with some real life interaction with money which is essential to learning how to manage it well. Knowing how much money they have in their bank account and earning their own money are both a valuable lesson in financial literacy.

Being money wise is very important to your child being able to get started on their own and make it in the world. Knowledge about money and how it works should be shared with them naturally as they grow and opportunities for discussion arise. Whether you are teaching them how to look at the price per ounce part of the stickers at the grocery store, or teaching them to save a portion of their earnings, learning these basic principles will help them immensely when they have to manage money on their own. A great place to start is by introducing a budget worksheet for kids.

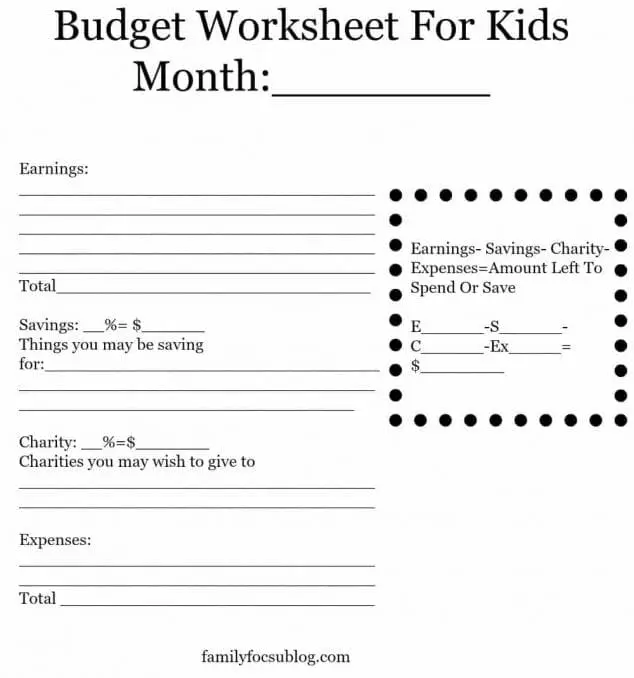

Budget Worksheet For Kids

There are many budget worksheet options out there that you can find to help you with the basics. Or just use a spreadsheet program on your computer. The left hand column can be for the days of the week and the columns that span the page across will be the categories like games, food, clothes, gifts, and savings. A budget worksheet for kids can be made to suit your child’s age and earnings.

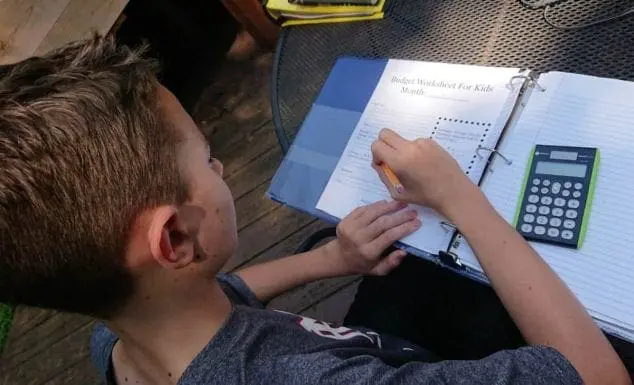

A budget worksheet for kids should include a place for what they earn, expenses, savings, and charity. Explain to them that they need to fill out their chart or do it together the first few times. Help your kids see how to disperse the money into the categories. If you incorporate a rule that 20% goes into savings and 10% to charity, those should come out first as well as any expenses. The rest can be divided into the fun areas and once they spend it, the money is gone. They will learn that they need to earn more.

You can use my simple Budget Worksheet For Kids that you see above. Additionally, you can find 13 different budget worksheets for kids and pick what best matches your child’s age and monetary experience level at moneyprodigy.com

Budgeting For Children: Set Goals And Provide A Budget Project

When you were younger, before the time of children and marriage, you dreamed of having a family and a home. These dreams became goals for you, things to accomplish and make your life richer in a more spiritual way. To be a realist though, money truly does make the world go ‘round. There is nothing wrong with wanting to feel comfortable in your situation or provide your family with a home. In fact, it sets a great example for your children.

Sit down with your kids and help them learn to set a short term goal (realistic) and a long term goal (big dream). It is great for kids to learn to work towards achieving their goals. Have them draw a picture of the goal and hang it by the budget chart so they see it every day and remember why they are saving their money. The short term goal can be something as simple as buying a Matchbox car or saving for new clothes. The long term goal can be putting their money towards a car and/or college. Have them pick an actual dollar amount to work towards. Once they reach it, they can set the same goal again or increase their savings goals.

Now that your child has some budgeting short-term goals, give them a project! You should only use this budget project for kids if they are old enough. Also wait until older kids have become familiar with using the basic budget sheet. See if they can use their budget sheets to calculate how long it will take them on their current allowance, or supplementing with additional earned income of blank dollars each month, to reach their small goal and their large goal. This is a great way to encourage high school kids to develop good money habits, earn extra money, and reach long-term goals.

Reward Your Child For Learning To Budget

You can expect some hesitation when it comes to financial education, a little bit of resistance even. As your children begin to take initiative in budgeting, be sure to encourage them with a shopping trip to buy that item they had been saving for. It is an important lesson and a good way to about the value of money and sound money management. These budgeting lessons are developing essential skills so that in the future they can set and meet their own financial goals. Besides basic skills you are building confidence in themselves.

Every new program needs to be tackled with a loving and supportive attitude. When your family members step up and apply the learnings, let them know how much you love and appreciate them back. Let them know you think they are smart kids for taking their budgeting lessons seriously. Be proud of their good financial decisions and be sure they know you are. Your reward doubles much later in life when they are financially stable people who pay credit card bills on time!

Conclusion

Being a parent is a true blessing, but one that does not come without its responsibilities. It will feel really good to know that by teaching budgeting for kids, you are helping to prepare them for a successful future. Teaching kids about budgeting is a valuable life skill! I hope you find the budgeting worksheets for kids useful.

Introduce basic concepts like saving, spending, and sharing from a young age. Help them set realistic financial goals, such as saving for a toy or a special outing. This can motivate them to save and manage their money wisely. Consider giving them a regular allowance tied to completing age-appropriate chores. This can teach them the value of work and money. By teaching your kids about budgeting early on, you’re giving them a strong foundation for managing their finances responsibly in the future. Understanding the concept of a monthly budget will give kids a huge leg up. Did the free worksheet help your child improve their budgeting skills?

Related Posts:

Teaching Kids How To Become Organized

Victoria says

I like the idea of doing a budget spreadsheet on the computer. What a great idea for also learning organization…thanks for a great budgeting article for how to teach my kids! A budget for kids is a great way for them to start to learn about money management.

Jio says

Hi Scarlet,

Awesome post and budgeting worksheets for students. We want our kids to grow in such a way that they should know all the basics of life. By that only they will get power to live in this world without any addiction to tension. Thanks a lot for essentials for teaching kids budgeting.

Raven says

Always useful articles. Even young kids should have a little money for chores so they can learn how spending money works.

James says

Thank you for this budget for teenager worksheet. It was really helpful for my son.

emma sallow says

Great post! I love the way you’ve covered how to teach your kids to budget. Your insights are always valuable and I always look forward to reading your blog. Keep up the good work!

Amelia says

Hi Scarlet,

This is such a practical and thoughtful guide for teaching kids about money! I love how it emphasizes starting simple, with allowances and piggy banks, then gradually introducing savings accounts and budgeting worksheets. Setting both short-term and long-term goals really helps children understand the value of planning and patience. Incorporating charity and fun spending also teaches balance. Using these hands-on tools early builds strong financial habits that will benefit them for life.

Ice Breaker Games says

Great tips on teaching kids budgeting! Using allowances to start makes so much sense. The free worksheet is a fantastic tool to help them practice. Excited to try this with my own kids!

Japanese Last Names says

Great tips on teaching kids budgeting! I really like how you show that allowance means kids are ready to learn money skills. The free worksheet idea is awesome – makes it so much easier for parents to start these important conversations. Thanks for sharing!

Marqetric Marqetric says

Loved this article! The way you explain budgeting for kids is clear and very helpful. Your posts are always insightful and enjoyable to read. Thanks for sharing!

Svarp Foundation says

A great resource for teaching kids smart money habits early. The free budget worksheet makes budgeting easy and fun to learn.

Sophia Taylor says

As someone who helps care for children, I see how important it is to teach money habits. Simple tools like budget worksheets make it easier for kids to understand saving and spending. Working as a nanny in Dubai, I’ve seen how these lessons help children develop responsibility and confidence from a young age. This guide is practical, easy to follow, and a great resource for both parents and helpers to use together in teaching kids about money.