Wow! It seems like so recently, I cradled my baby girl in my arms and now her high school graduation is approaching! As a parent, there are a lot feelings that accompany this monumental event, one of which is pride. She has put in a lot of hard work and now she is choosing which […]

college

How To Talk To Your Kids About College

As a parent, talking to your kids frankly about college is one of the most important things you can do. Ensuring they understand what they’re getting into can help them make better decisions in the future and live the life they want. But how do you approach this discussion? What should you even say? When talking […]

College Move In Checklist And Preparation Tips

Lots of my friends have kids going to college for the first time this year. Most parents are sad, anxious and excited all at once. As most moms know, planning for your kid’s big move to college can be an emotional and stressful time for both parent and child. This is especially true when preparing […]

How To Help Seniors With The College Application Process

The admissions process for college can be a daunting task for seniors and their parents. I am so honored to have the parenting expert and author of the recently released, A Survival Guide to Parenting Teens: Talking to Your Kids About Sexting, Drinking, Drugs, and Other Things That Freak You Out, Joani Geltman, MSW, agree […]

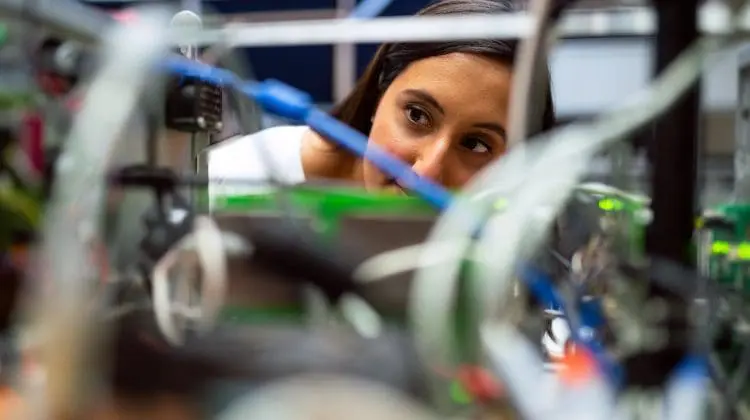

Top Undergraduate Engineering Schools On The East Coast

If you are looking for facts and statistics on the top engineering colleges on the Eastern Coast of the United States, I have those for you. What’s more? I know the college search can be intense and confusing at times. That is why I also have a personal story to share of my daughter’s journey […]

How To Prepare Financially For College

There is no doubt that college can be an expensive, but important, investment in your child’s future. College tuition bills are skyrocketing and so is student debt. Financial planning for college is a necessity. This article will give you several strategies to financially prepare for the cost of college. I’ll start with tips for how […]

Tips For How To Get Scholarships For College

As a parent of two teenagers, I can tell you that college is on our minds already and so are scholarships. I certainly don’t want my children to saddle themselves with huge student loans. They know how important a good education is and they know that means giving their studies full effort now. They also […]