It’s all about the money! Well, not really but you also can’t deny that having your monetary affairs in order makes everything a whole lot easier. That includes relationships. In fact, according to Ramsey, “Money is the number one issue married couples fight about, and it’s the second leading cause of divorce, behind infidelity.” If you are in a relationship, you probably have already felt the tension that can take hold when a money discussion comes up. People can have such varying points of view on finances and what it is OK to spend how much on. That is why I am very happy to have an expert share some tips with us today on how to talk to your spouse about money without fighting.

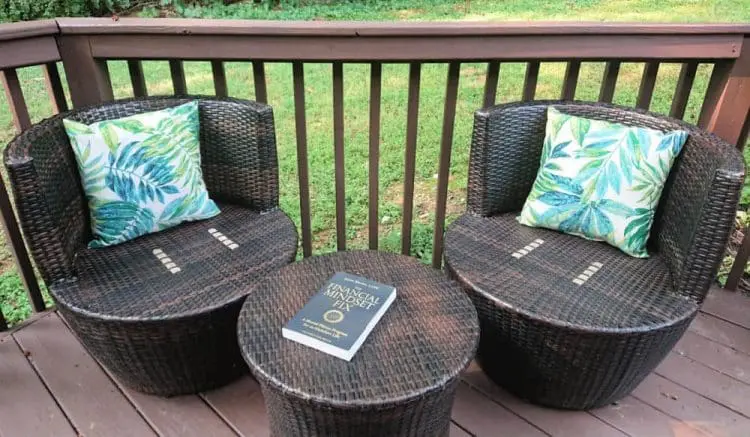

I recently read a great book by Joyce Marter called THE FINANCIAL MINDSET FIX (Sounds True, July 27, 2021) and I really enjoyed her writing style. Financial matters can overwhelming and they can also be stuffy and hard to grasp. Not so with Joyce Marter’s book! She is a therapist, entrepreneur, adjunct professor at Northwestern University, and national speaker. I believe it her therapist credentials that makes her writing so easy to understand. She knows how to explain concepts and she knows how to peel away the layers of programing and emotions that we all attach to money. She does an amazing job in her book presenting effective practices for success, and 12 mindset shifts, to transform one’s relationship with wealth. This book (here’s my affiliate link to it on Amazon) also has a ton of worksheets to help people understand your spending habits.

But, let’s face it. Your relationship with money and debt becomes even more complex when you add a spouse to the equation. What was already a stressful topic, is now something you need to share with your partner and agree on! That can seem like a tall order at times. Here is some great advice from Joyce Marter on how to talk to your spouse about money without fighting. Dealing with couples finances while avoiding conflict will help circumvent the money problems that can occur and build up when you try to ignore finances.

How To Talk To Spouse About Finances

by Joyce Marter

According to a new survey, fighting about money is the second leading cause of divorce, behind infidelity. Also, high debt levels and a lack of communication are major causes of stress and anxiety surrounding household finances. These challenges can negatively impact your family’s happiness and financial future.

One of the main reasons couples come to therapy is financial conflict. Money means different things to us based on our earlier life experiences. Some are spenders while others are savers. Some are very conservative, while others have higher risk tolerance. Trouble could be brewing if you and your partner have conflicting beliefs.

Emotions surrounding money—especially debt—may be one of the barriers between spouses when talking about their finances. In a recent study, almost half (47%) of respondents with consumer debt say their level of debt creates stress and anxiety. Sixty percent of those with consumer debt say they worry about finances monthly, and one in four say they worry about finances every day. With this charged topic, it is no wonder that talking about money can lead to fighting.

5 Steps to Improve the Financial Health of Your Family

Take these five steps today to improve your financial communication with your partner and kids.

Step 1: Schedule a financially focused date night

Yes, that’s right, a date night focused on money talk. This is not the type of conversation you want to slip into during pillow talk. Schedule a time in advance, so you both have time to come grounded and prepared. Make it something special by ordering or cooking your favorite meal along with getting dressed up for the occasion. Focus on collaboration and working on the same team to achieve common goals.

Make it a monthly date. By doing so, you can talk about what is working and what’s not. And also celebrate success. By consistently keeping these date nights on your calendar, you’re not only putting time, energy, and effort into your finances—you’re keeping the lines of communication open.

Step 2: Keep an open mind

We all carry unique money mindsets as we come from different upbringings, cultures, and environments that helped shape how we think about finances. Use this mantra to help keep your mind open to new ideas and ways of thinking:

I listen to what others have to say. I am open-minded and understanding.

Honor your partner’s emotional experiences. Practice empathy and normalize and validate their feelings, so they feel heard, known, and understood. Detach from fear and avoid defensiveness and reactiveness.

Step 3: Be assertive

Talking about finances may bring up issues from the past, whether a shared experience or a personal trauma. Stay in the present and don’t dredge up problems from the past. Ask for what you need to hear, say “no” to what you don’t feel comfortable sharing yet, and be open to negotiation and compromise. Express your feelings in a way that is clear, direct, and appropriate.

Use “I” statements rather than “you” statements to reduce defensiveness and set healthy boundaries.

Step 4: Take baby steps

Start by talking about daily spending, then work yourself up to retirement and life savings conversations. Pace yourself. Often, it’s delving into these bigger topics without understanding your partner’s money mindset that causes arguments and hostility. Work your way up.

Step 5: Learn together

Starting a conversation about finances can be intimidating because many of us don’t know all the fancy terminology. Use this opportunity to grow together. Promote your financial literacy and involve your kids in some of those conversations. Work with your partner to set healthy financial boundaries with kids or extended family.

Seek the help of a financial planner or debt counselor. Not only will this help you feel more confident about money matters, but it also makes you feel more comfortable talking to your partner about finances with the help of a neutral mediator.

As we learn how to communicate and resolve disputes around money, the fights about money will be replaced with mindful conversations that lead to opportunities for growth. Download my free A Guide to Money Talk With Your Partner to learn more and consider working the program in my new book, The Financial Mindset Fix: A Mental Fitness Program for an Abundant Life. Your family deserves financial peace and prosperity!

Conclusion

I hope this great advice from Joyce Marter helps you broach the money talk with your spouse. These tips should help you feel more confident and have the right mindset going into the conversation. Scheduling the money talk with your spouse for an agreed upon money date night is a great way to make sure you are both prepared for the conversation and you both get to share your ideas as well as concerns. Remember, learning to work together is a big part of marriage and it is so rewarding when you get there!

Talking to your spouse about money doesn’t have to lead to arguments. By approaching the conversation with empathy, openness, and a shared goal of financial well-being, couples can build stronger trust and teamwork. Remember to listen actively, avoid blame, and schedule regular check-ins to stay on the same page. When money becomes a partnership instead of a power struggle, it paves the way for a healthier, more connected relationship. Do you have any questions or feedback about how talk to your spouse about money without fighting? Share them in comments below or tweet us at @familyfocusblog and @joyce_marter.

Related Posts:

How To Open A 529 College Savings Plan- Easy And Free!

Jackie says

This is such great advice! Talking about money can be one of the toughest parts of a relationship, but your tips really help shift the focus toward teamwork and understanding. I love the idea of regular check-ins—such a simple way to stay connected and avoid misunderstandings.

Clemens Bailey says

Your writing has a way of resonating with me on a deep level. I appreciate the honesty and authenticity you bring to every post. Thank you for sharing your journey with us. Money can be hard to talk about if you have different visions. Sharing how you both feel and why is very important to getting on the same page. Compromise will flow naturally from that.

Pakistan Savings says

Scarlet, this post offers such clear and compassionate advice on a tough topic. Your tips make financial conversations feel more approachable and respectful. Thank you for shedding light on such an important aspect of relationships!

Deck says

This is such a helpful and balanced post—money conversations can definitely be tricky in relationships, but your tips make it feel more manageable. It’s all about open communication and shared goals, whether you’re budgeting for daily expenses or planning home improvements. We recently worked with some excellent deck contractors in Maryland to upgrade our outdoor space, and having that financial conversation ahead of time made the process smooth and stress-free. Thanks for the great advice!

Lucy says

Talking about money with your spouse can be one of the most challenging yet essential conversations in a relationship. Money often carries deep emotional weight and differing habits or histories can lead to misunderstandings and conflict. However, with the right approach, couples can discuss finances openly and constructively without fighting. Thanks for sharing these expert-backed strategies to help me navigate these conversations smoothly.