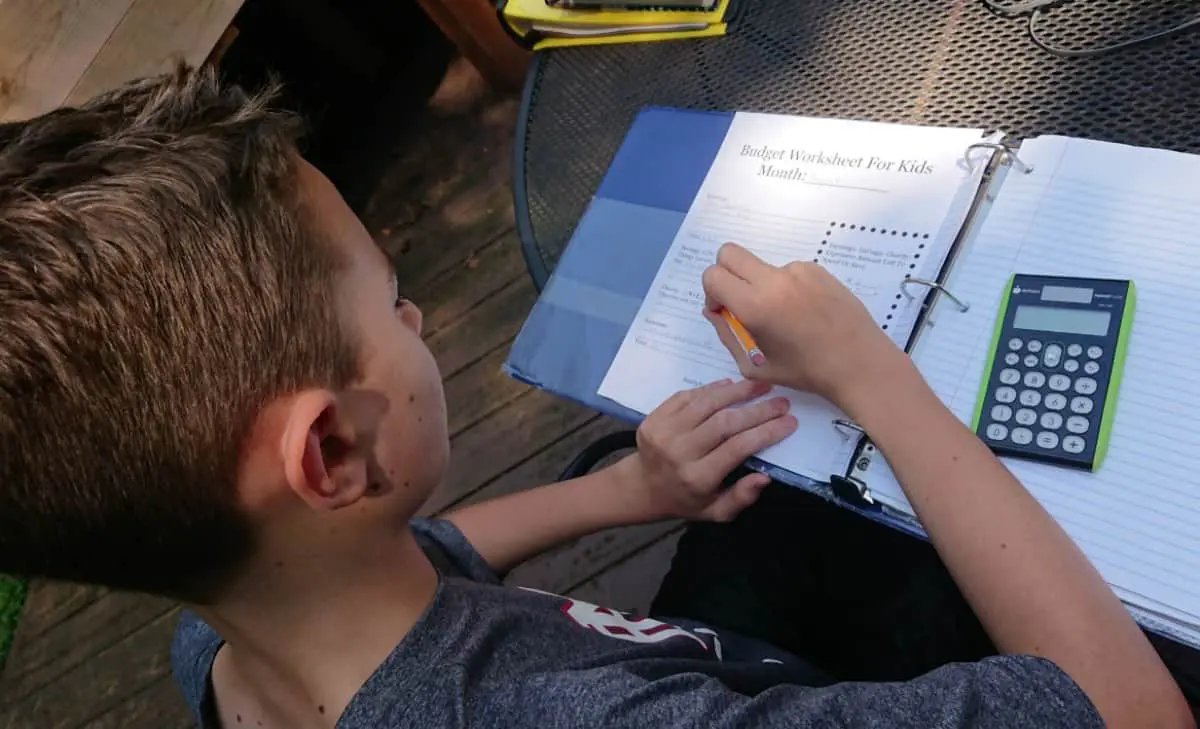

As parents, it is our responsibility to teach our children financial awareness. This includes showing younger kids how to budget their money from an early age. Including them as a part of the family budgeting plans is a great thing, but it does not relate directly to them on their level. Therefore, helping your kids […]

finances

10 Strategies For Wealth From Leanne Jacobs

I am so excited to have Leanne Jacobs, an internationally recognized author and holistic wealth expert, share with us some of her best strategies for wealth. These wealth strategies are intended to help us stop stressing and achieve “family financial bliss.” Well, who doesn’t want that? I am all ears because I am definitely still learning […]

How To Manage Money As A Couple: The Ultimate Guide

Money is known to be a leading cause of stress in romantic relationships. It can be challenging to merge two financial lives together, especially when each partner has different spending habits, financial goals, and expectations. However, managing money with your partner doesn’t have to be a source of tension in your relationship. It can be […]

Why Now Is The Best Time To Invest In Gold

Are you wondering, “Is now a good time to buy gold?” Well, investing in gold can be an excellent way to secure your financial future. Now is the perfect time to invest, as gold prices have risen significantly over the last few years. Experts believe it’ll continue to increase. This article will explore why now is […]

Tips For How To Get Scholarships For College

As a parent of two teenagers, I can tell you that college is on our minds already and so are scholarships. I certainly don’t want my children to saddle themselves with huge student loans. They know how important a good education is and they know that means giving their studies full effort now. They also […]

List of Essential First Time Homeowner Tips

So you’ve made (or are thinking about making!) the big jump into one of the biggest life investments you will make- buying a home. This will be one of the most exciting chapters in your life but it won’t come stress-free. Owning a house and making it your home is such a fun experience. However, […]

How To Catch Up On Retirement Savings

My Uncle Dale always said that you have to start saving early. And I did. Like a good little kid, I opened a savings account. I saved all my money from odd jobs like crawfishing, candy selling, and babysitting. By the the time I graduated from high school, I saved up around $2000. I thought […]